A write-off means marking a part (or all) of an unpaid invoice amount as uncollectible—meaning you decide not to collect that money from the client anymore.

Use Case Example

Let’s say you issued an invoice for ₹10,000 to a client, but it is still unpaid even after multiple reminders.

So you decided that the client won’t pay the amount; hence, you write off that amount.

Common reasons for write-offs

Bad debt— Client is unable or unwilling to pay.

Invoice error - Overbilling or incorrect charge that cannot be adjusted through a credit note.

Discount or waivers - Business decision to reduce the amount due.

Consequences

Reduces account receivables.

Increases Bad Debt expense.

Shows as a loss in P/L Report.

Invoice remains marked as Written off.

Steps to mark a invoice as written off

Click on Invoices.

Click on the invoice you want to write off.

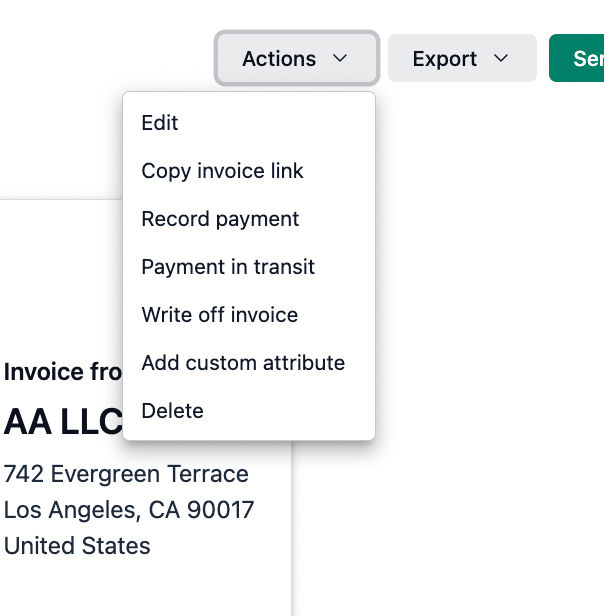

On the invoice page, click on Actions.

Click on write off.

A pane will appear, enter the notes (optional).

Click on Write off invoice button.

The invoice will be written off.